Manage Accounts with Odoo Accounting Module

Because the module is automated, double-entry bookkeeping can be completed quickly. During each transaction, entries are made automatically into the journals based on data obtained from other modules. As new actions occur, the entries are immediately updated. The module allows you to track and manage the company's revenues and expenses. The Odoo Accounting module manages the accounts and operations connected to vendors and customers in a methodical manner.

Odoo Accounting Module

Odoo Accounting Module Manage Accounts

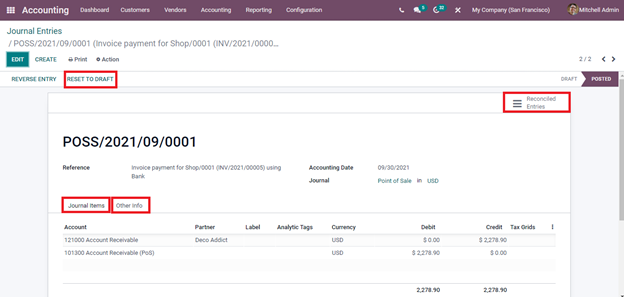

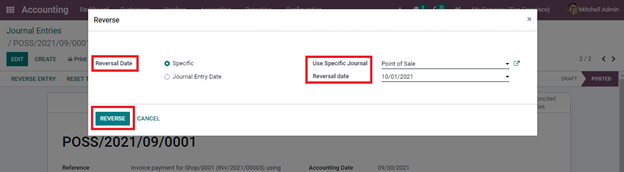

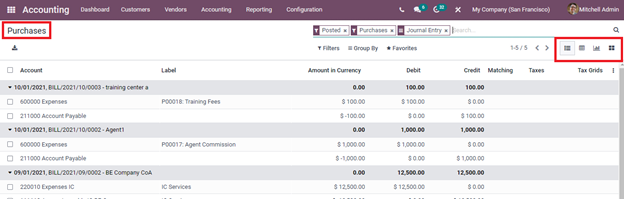

Simply click on the journal entry from the list to see additional information about it. The Journal Items and Other Information are among these details. The Account name, Partner name, Label, Analytic Tags, Currency utilized, Debit amount, and Tax Grids can all be found under the Journal Items menu. Details such as whether the entry should be posted automatically or not, whether the entry should be checked again or not owing to inadequate data during entering, and the Fiscal Position are all listed under the Other Info option. The RESET TO DRAFT button can be used to reset the status of a journal entry from POSTED to DRAFT. Select the Reconciled Entries option to see the reconciled entries.

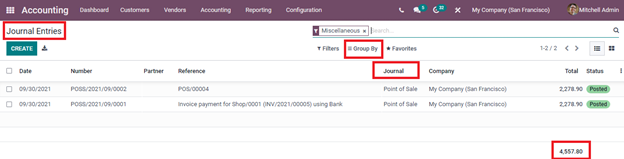

Journal Entries

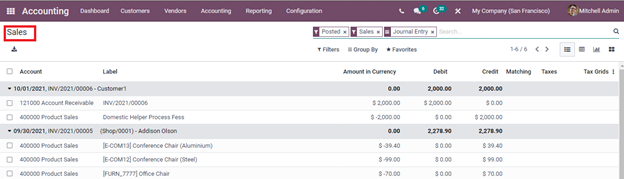

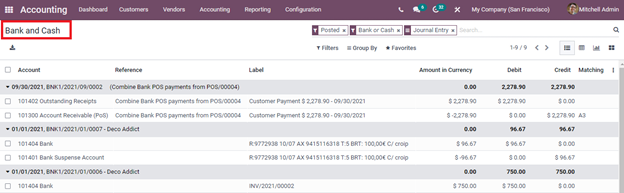

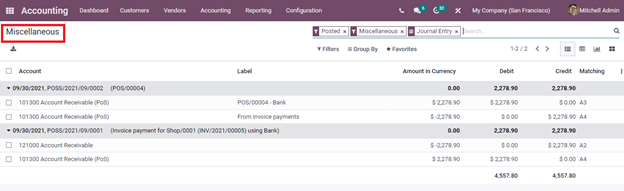

You may access the journals pertaining to Sales, Purchases, Miscellaneous, Bank, and Cash in the Odoo Accounting module.

Let's take a look at each one separately.

Let's take a look at each one separately.

Manage Accounts

(Odoo Accouting Module)

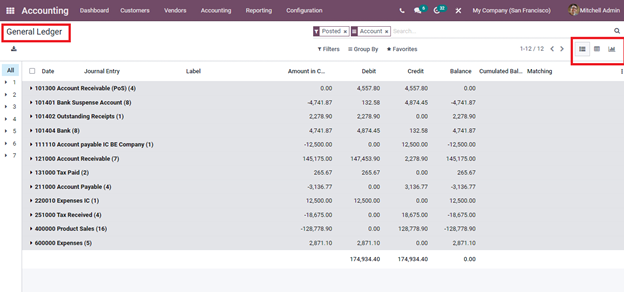

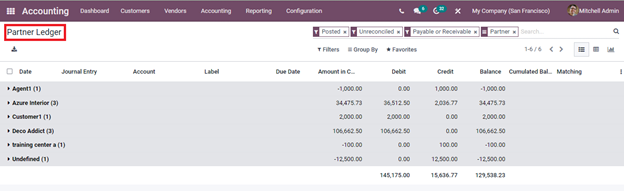

Ledgers

The ledgers contain accounts for inventories, accounts receivable, accounts payable, investments, deposits, and many other things. In a nutshell, it is the record that is utilized to keep track of the bookkeeping entries for the balance sheet and income statement. Both General Ledger and the Partner Ledger can be viewed in the Odoo 15 Accounting module.

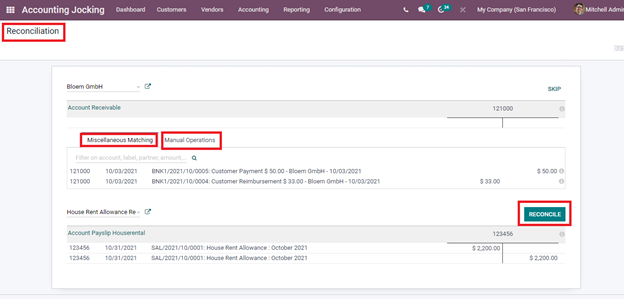

You may check the specifics of the reconciliation process by selecting the Reconciliation option from the Accounting menu. This allows you to compare the bank statements to the accounting of the company. By following this procedure, you may ensure that the two accounts are identical. You can see the name of the Partner as well as the Amount Receivable in the Reconciliation pane. You can match with entries that aren't from receivable or payable accounts under Miscellaneous Matching. Account, label, partner, and amount filters are also available. You can add Account, Taxes, Journal, Label, Amount, and Write Off Date to Manual Operations. If you're not sure about something, turn on the To Check option, which will prompt you to double-check the information. Click the RECONCILE button to reconcile the statement.

Manage Accounts with Odoo15 Accounting Module