Odoo 15 Disallowed Expenses

- For starters, the tax that must be deducted from the total amount on specific expenses is not deducted at the time of payment.

- The expenses being defined have nothing to do with the company or profession.

The following are some examples of Disallowed Expenses:

- Personal health insurance, life insurance, and automobile insurance

- Items that have been misplaced or stolen

- Personal property damage, such as vehicles, clothing, and other goods

- Apps or software for personal devices that have been downloaded.

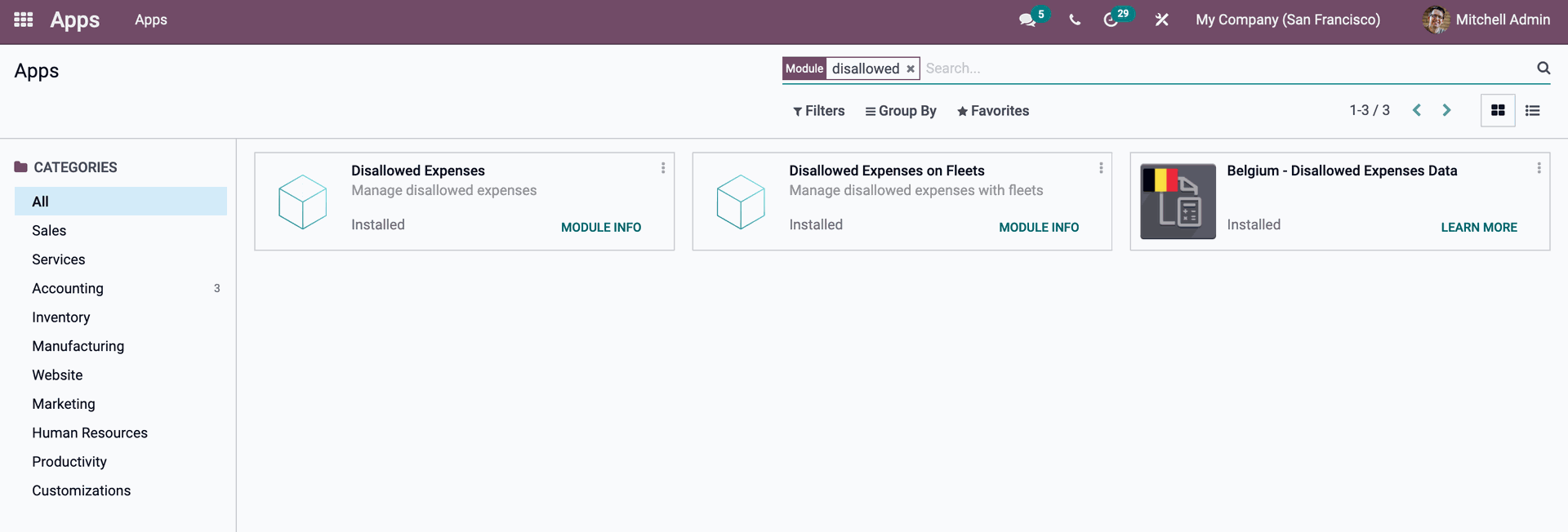

To set up Disallowed Expenses in Odoo, we must first install the Disallowed Expenses module from the Apps menu.

This article explains how to use Odoo 15 Disallowed Expenses.

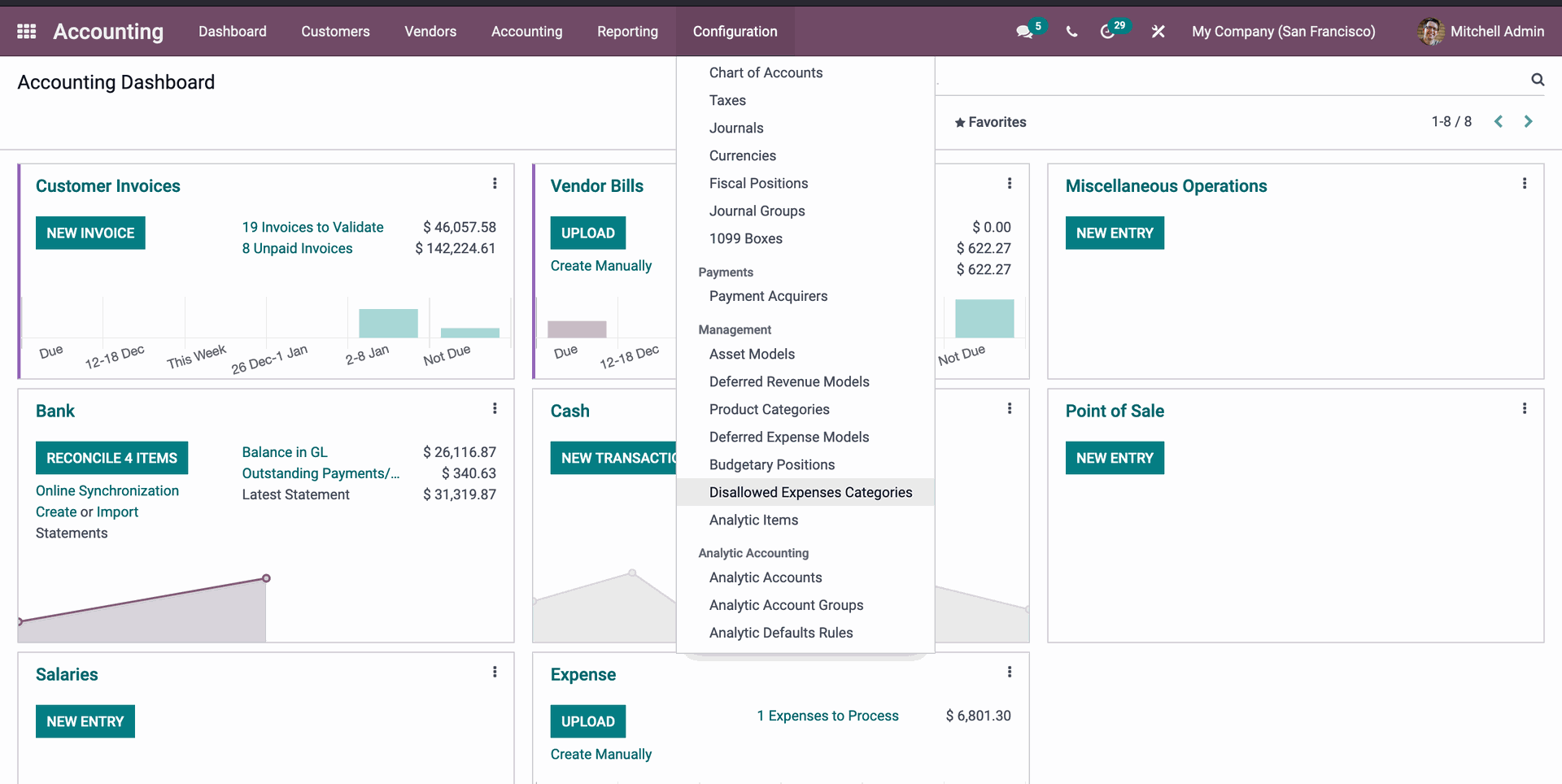

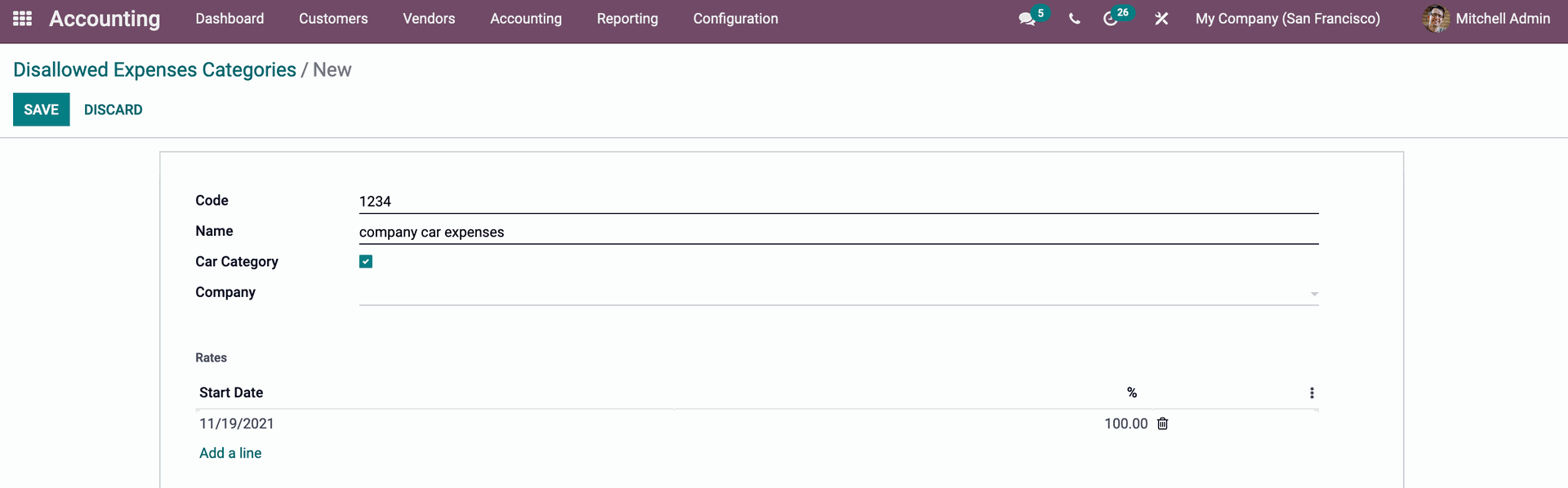

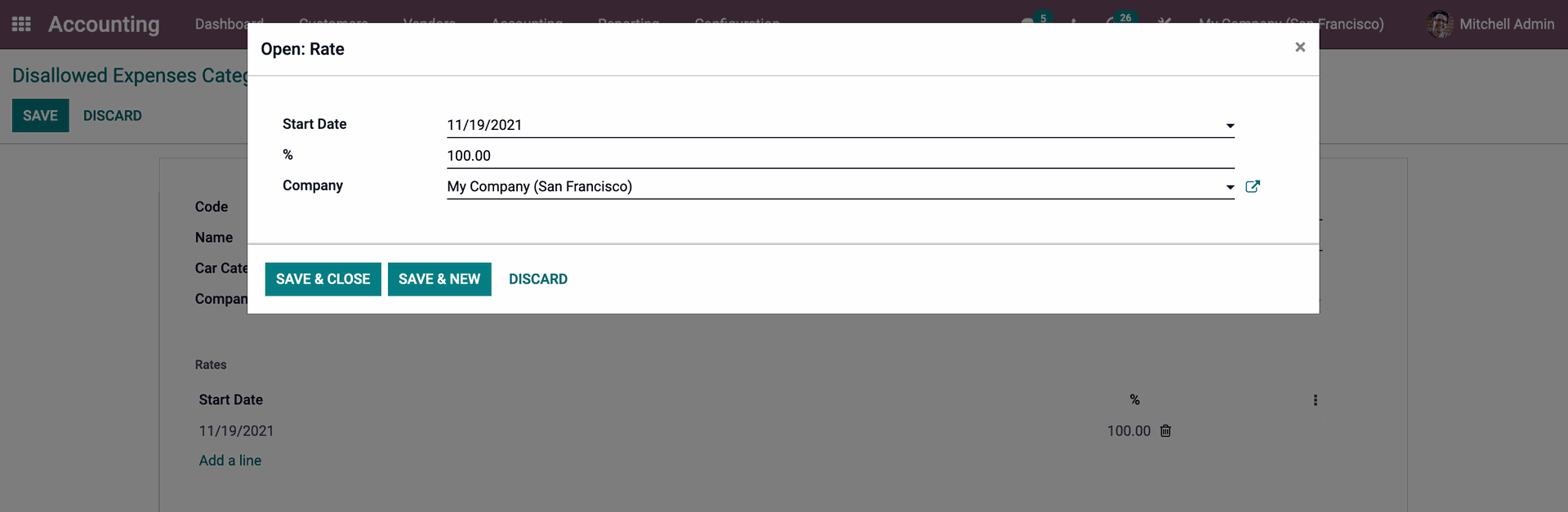

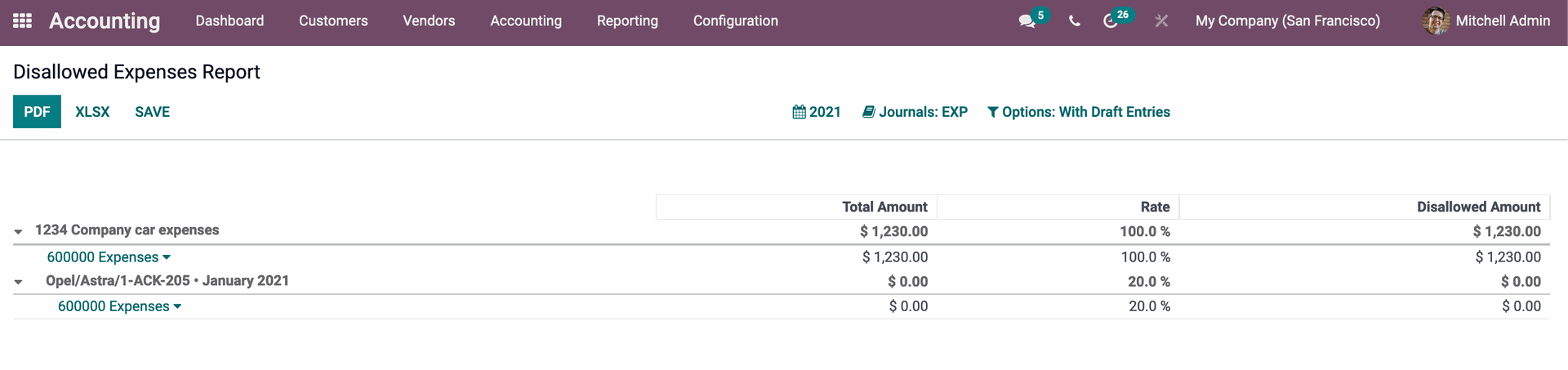

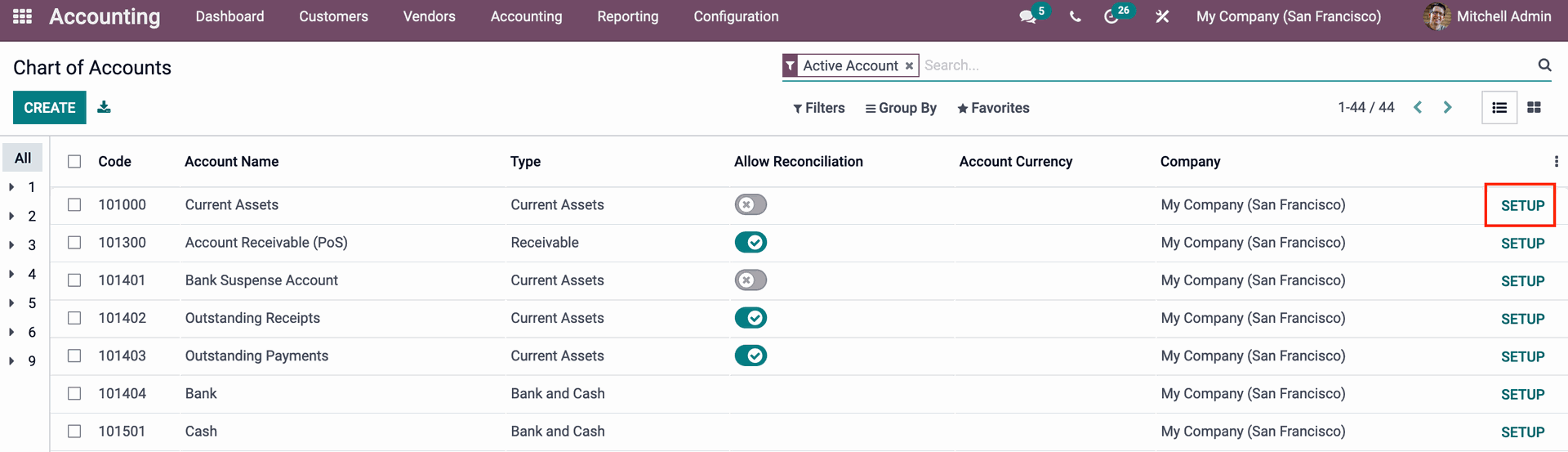

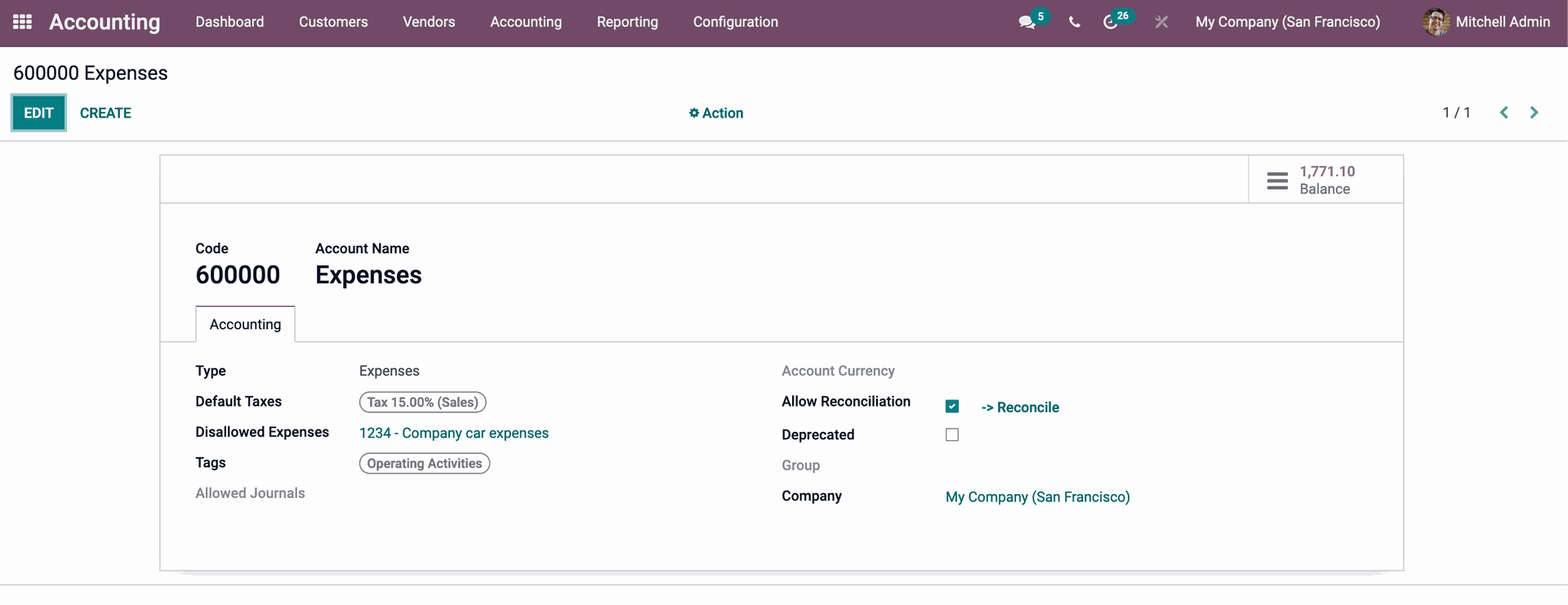

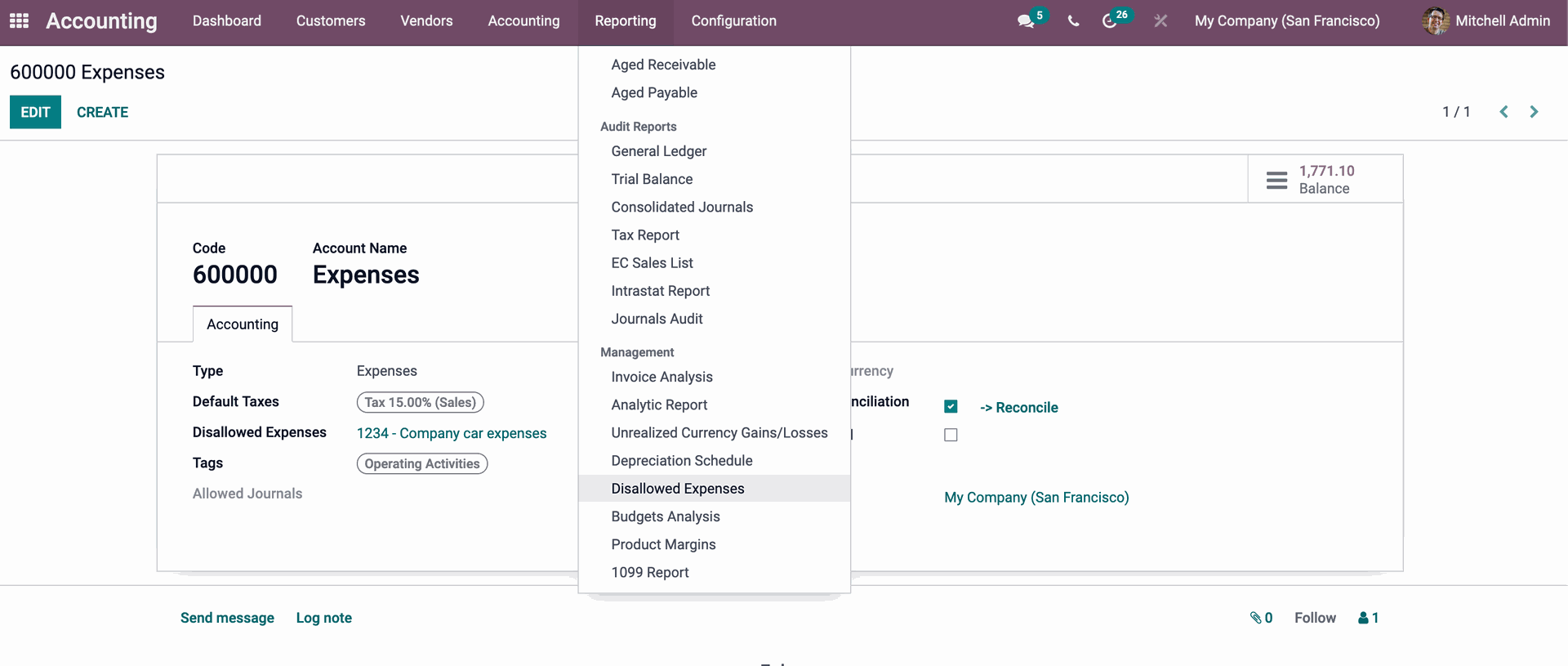

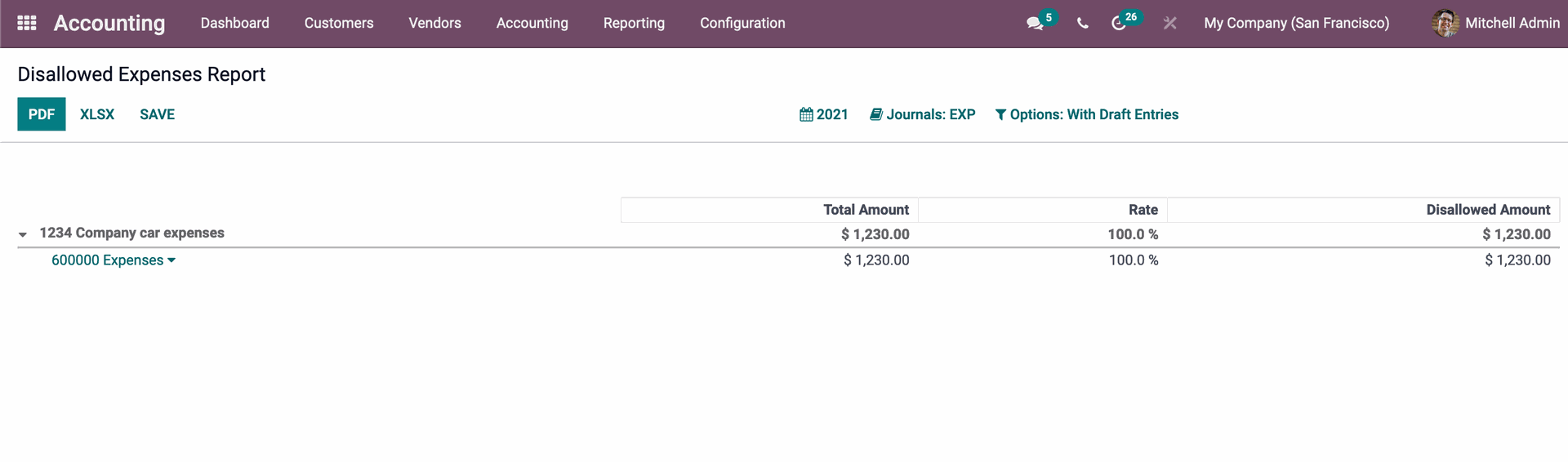

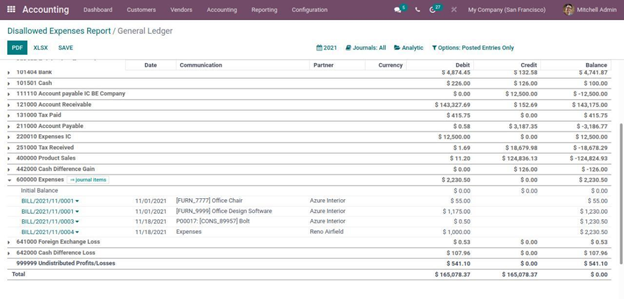

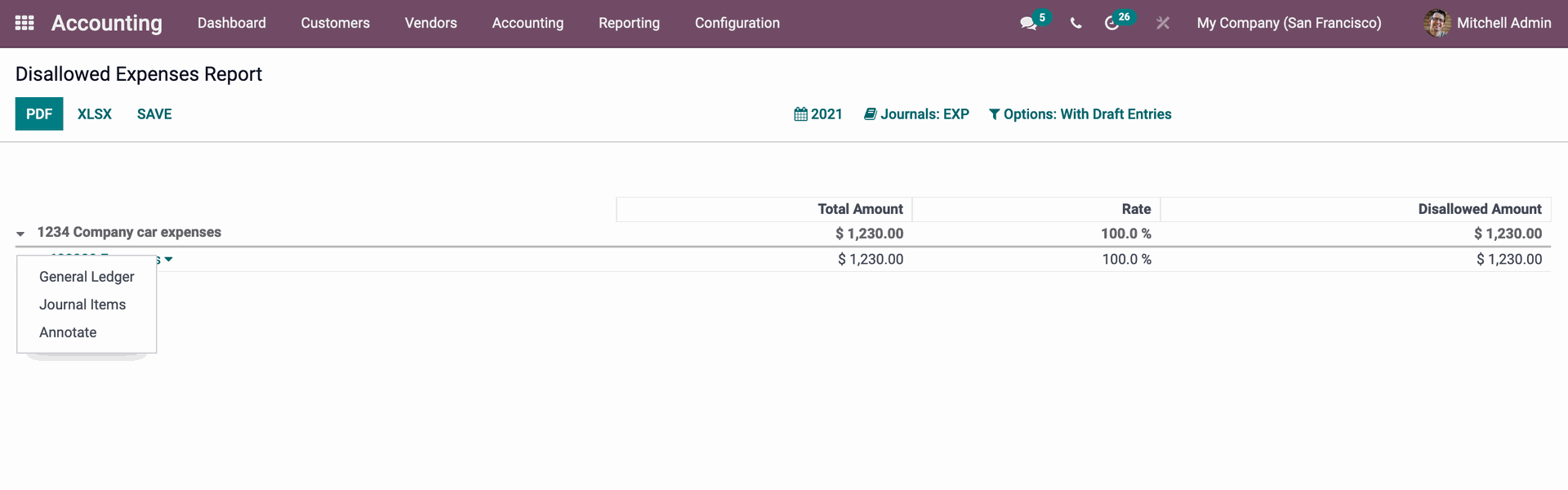

Furthermore, an Expense Account defined in the Chart of Accounts can be linked to the Disallowed Expenses Category. To do so, go to Chart of Accounts and choose the Expense Account. Then click the SETUP button, and you'll have an option to select Disallowed Expenses in that box. You can also add a Disallowed Expenses Category, which will be linked to the appropriate account.

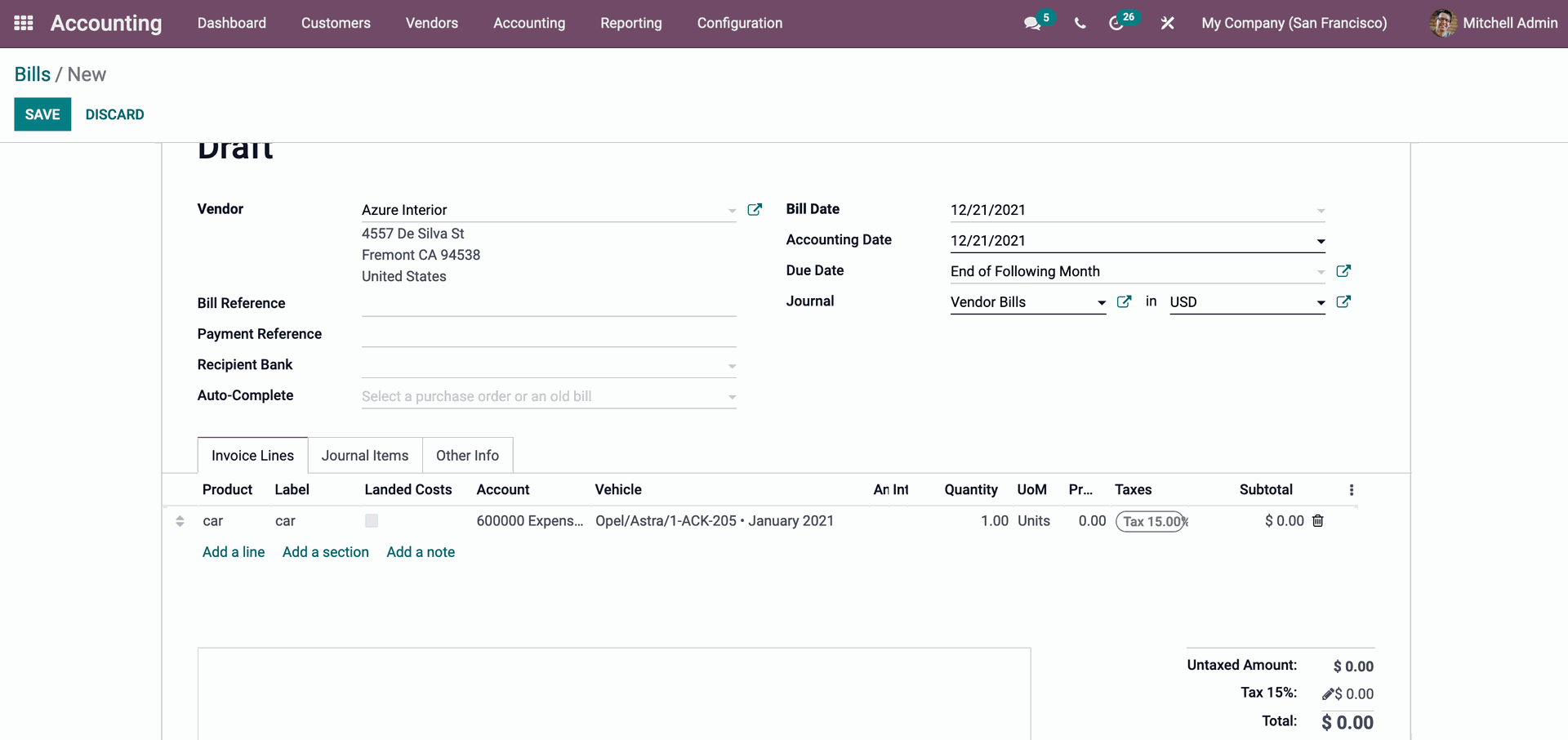

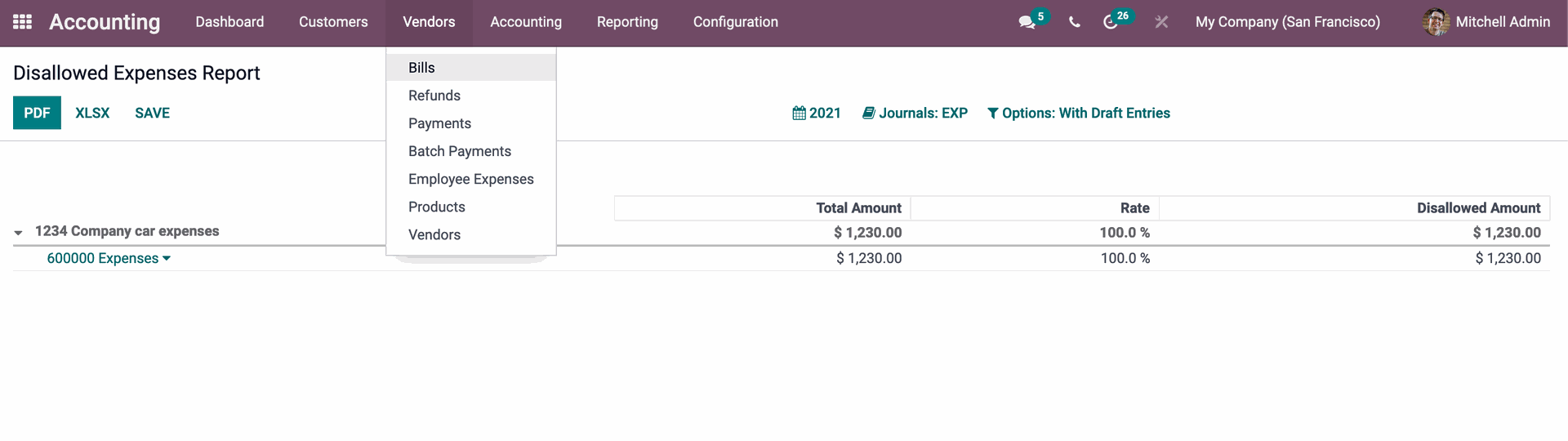

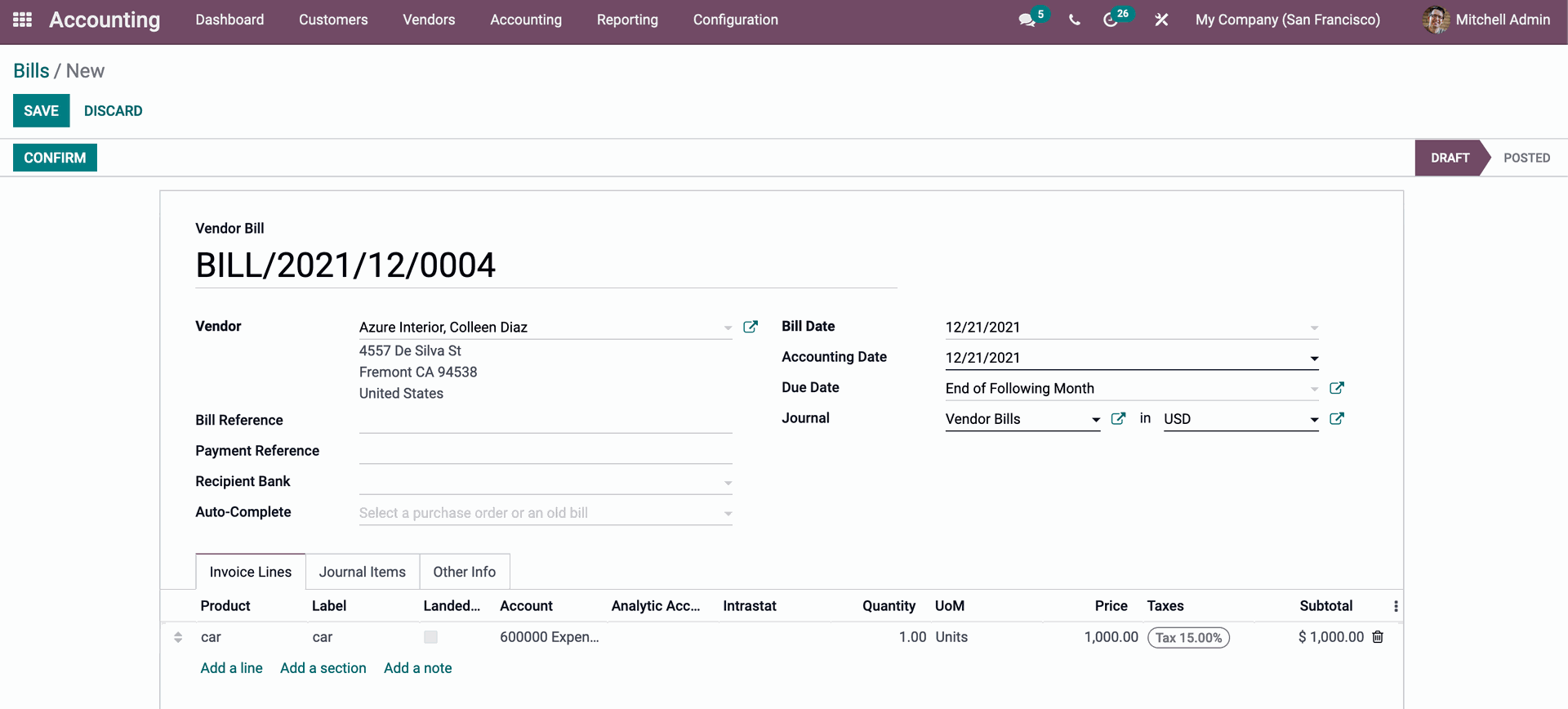

In Vendor Bills, link the car and use it for Disallowed Expenses.

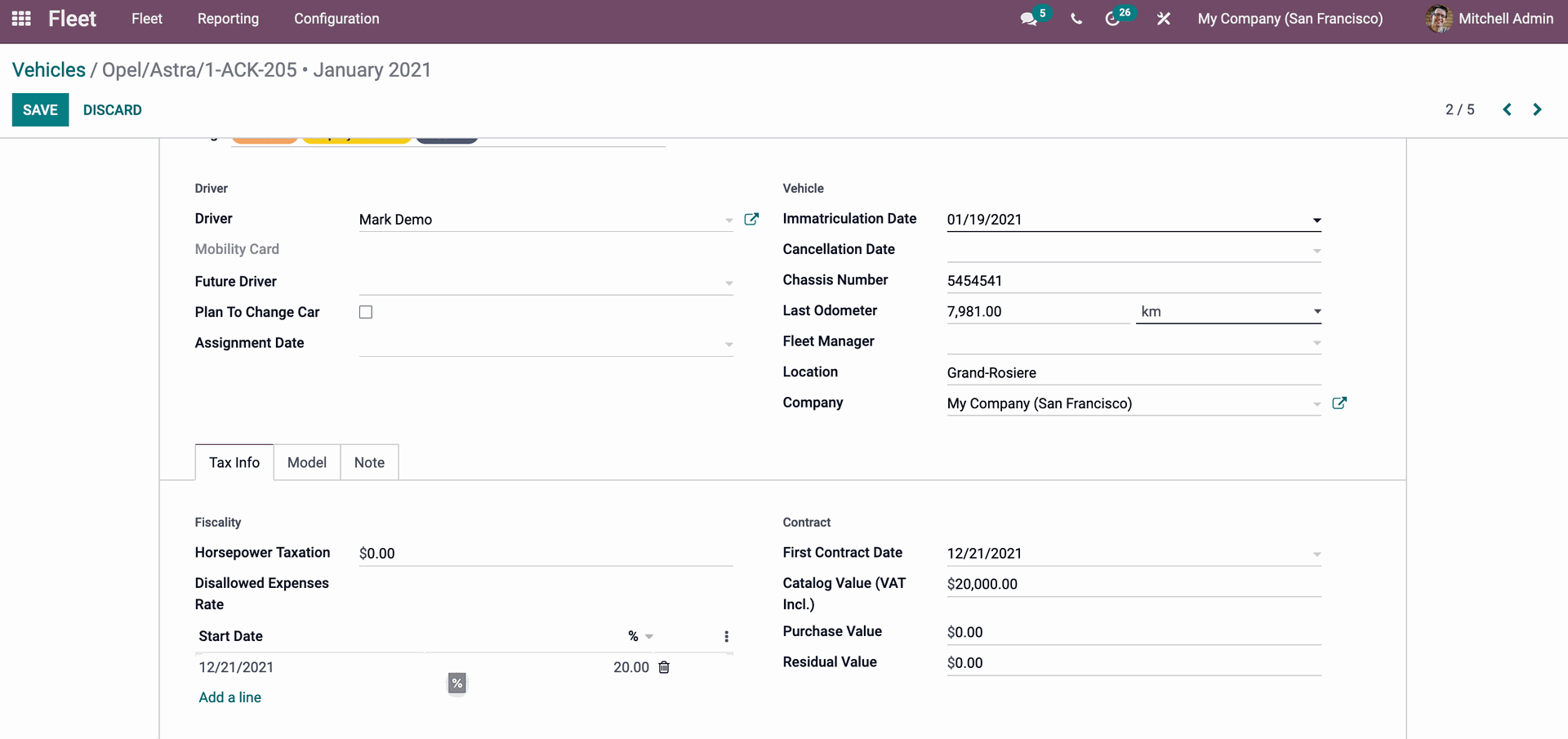

Disallowed Expenses are also linked with the fleet module in Odoo platform Version 15. So you may utilize the Odoo Fleet module to simply connect the car to the system.

Start writing here...

Odoo 15 Disallowed Expenses