Odoo Bank Statement Management Benefits

Banking operations are incredibly simple to administer using Odoo. You can carry out any banking-related operations from any location on the planet. With the help of the Odoo 15 Accounting module, you can simply manage complex banking and accounting procedures from various bank accounts.

This blog will show you how to link and configure your bank account in Odoo 15 Accounting.

Bank Statement management

Importing bank statements to Odoo will allow you to keep track of your bank account's financial movements and compare them to the transactions recorded in your accounting books. Bank synchronization allows you to import your bank statements into Odoo automatically. This solution is just too simple to implement, and Odoo will make certain that no bank statement data is overlooked.

If you don't want to use the Bank Synchronization technique, you can manually enter the bank statement or import the bank statement that was supplied by your bank.

Import Automatically

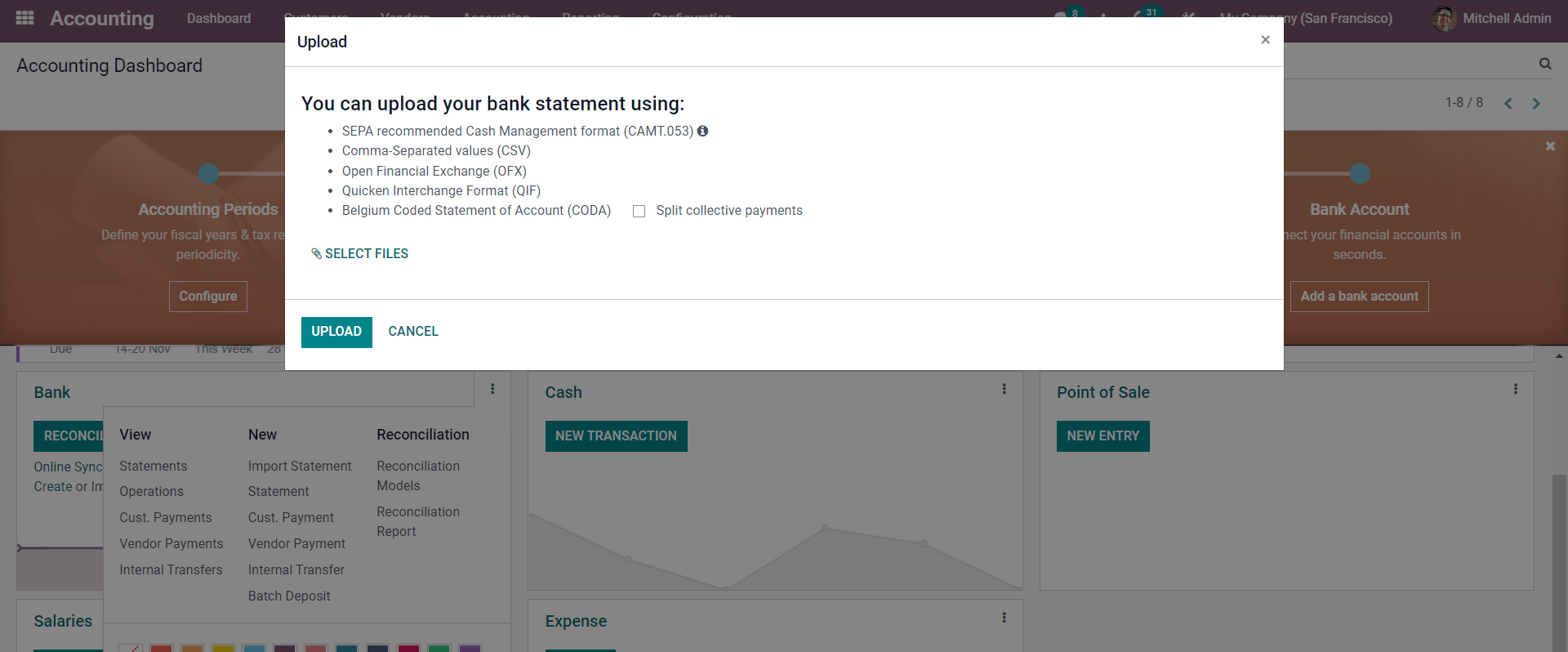

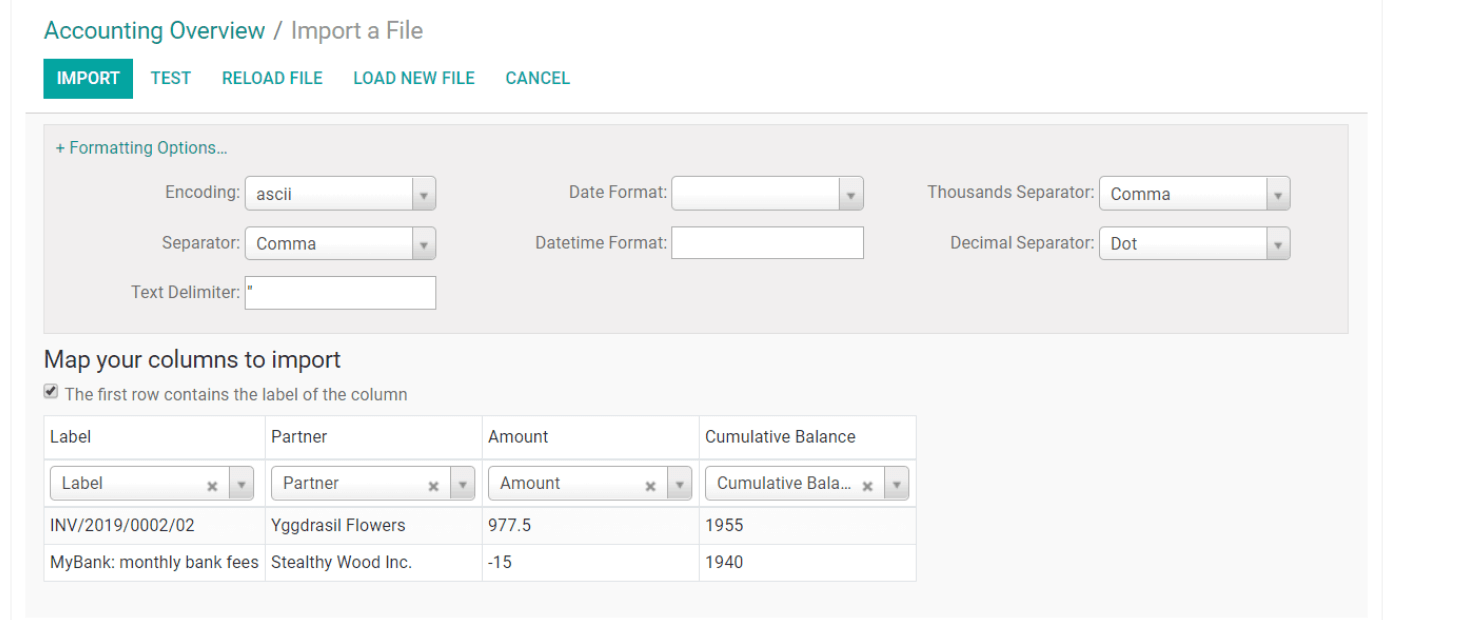

Odoo allows you to upload bank statements in a variety of complex file formats. Go to the module's dashboard to import the bank statement. Select your bank from the Overview area and click the 'Import statement' option as shown below.

A new import widget will appear, as seen below, allowing you to customize the file you want to import.

Manual Method

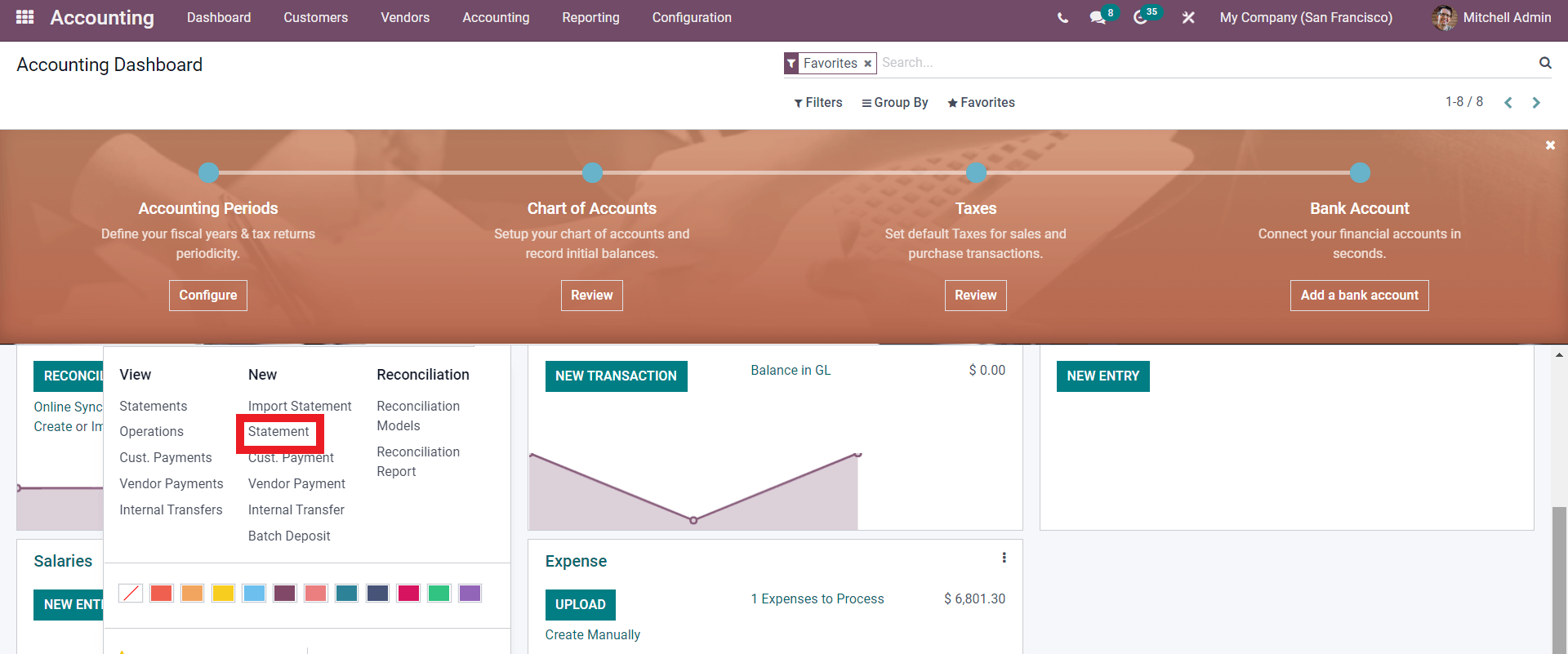

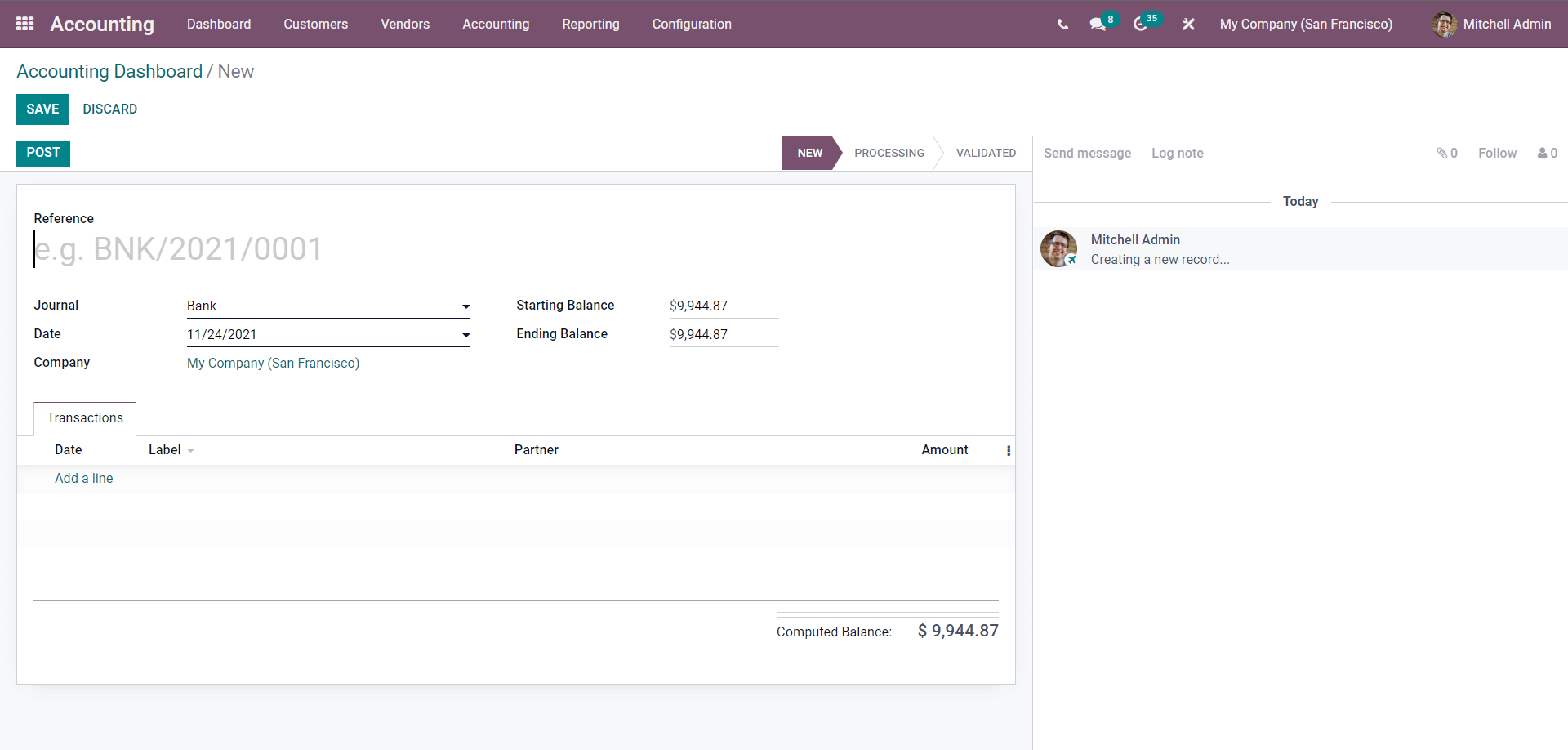

You can manually enter the bank statements into Odoo if you prefer the manual technique. To do so, navigate to BANK in your Accounting module's Overview dashboard. Click on the dots to the side of the section and select Statements from the options under NEW, as shown below.

A punchy Headline

Choose a vibrant image and write an inspiring paragraph about it.

It does not have to be long, but it should reinforce your image.

Note that manually entering Bank Statements is prone to error, so make sure you read over the information at least twice to confirm accuracy, as Odoo considers all of it.

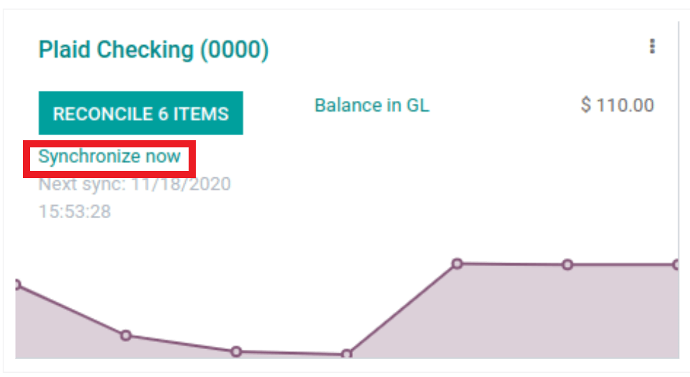

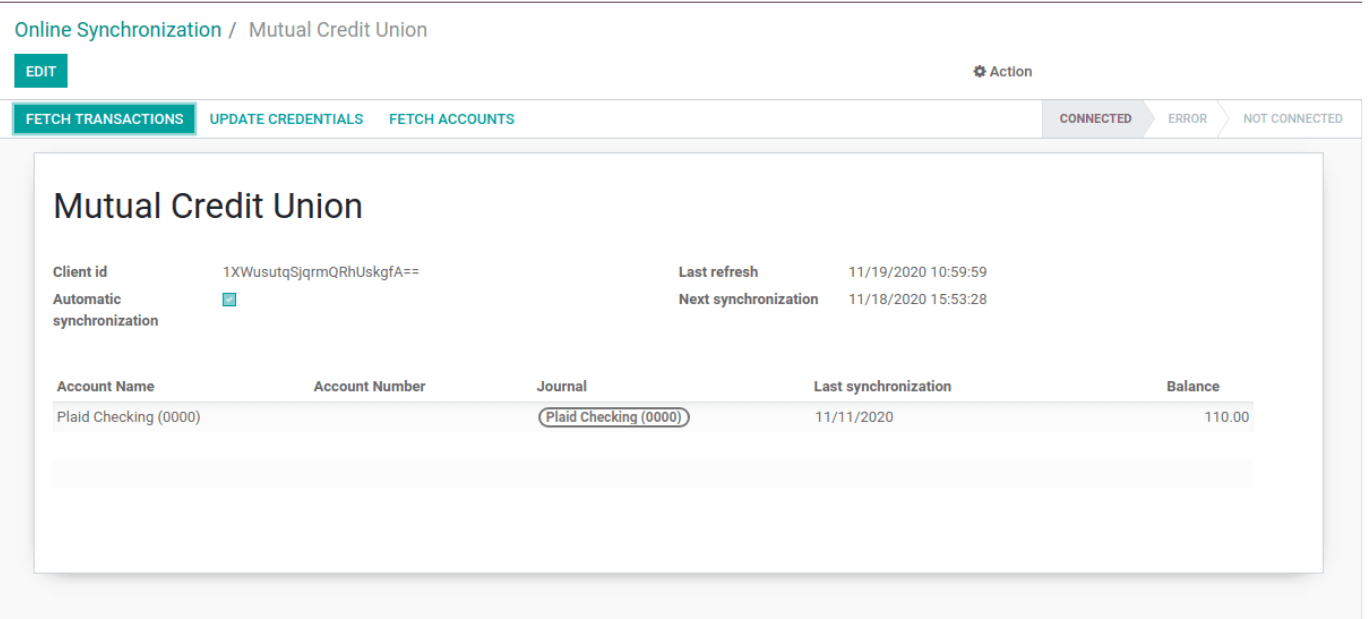

Odoo can sync with your bank and instantly import all of the data from your bank statements into your Odoo database. After the synchronization, you can conveniently manage your banking.

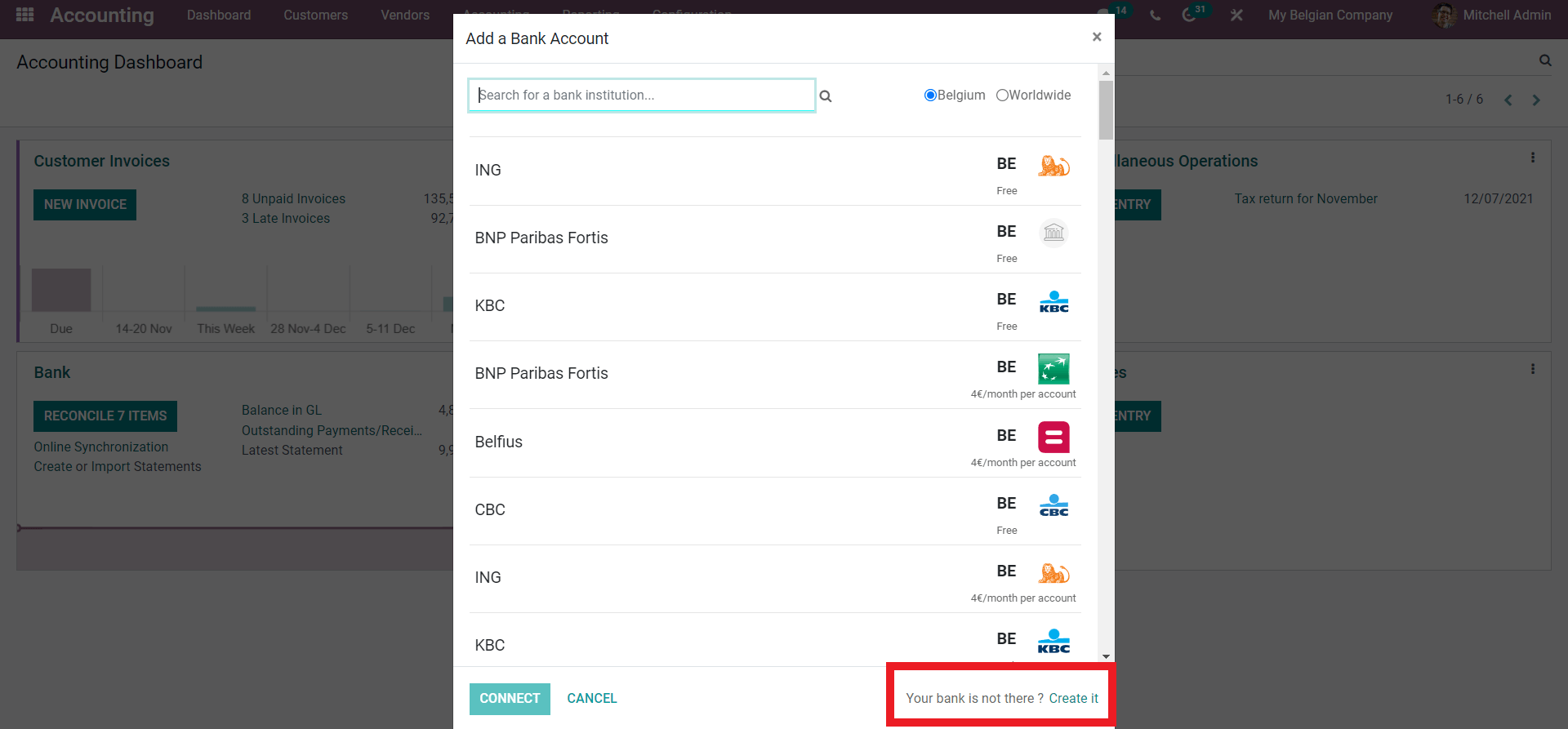

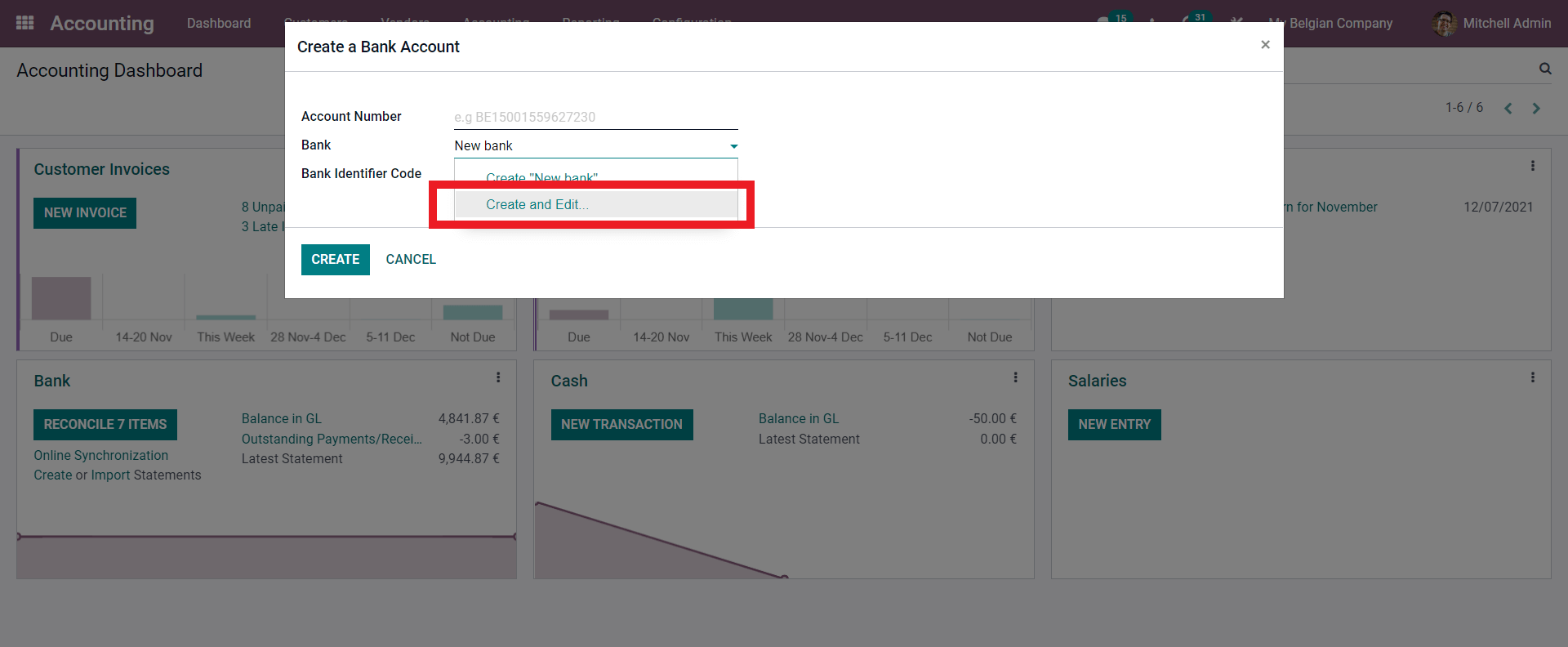

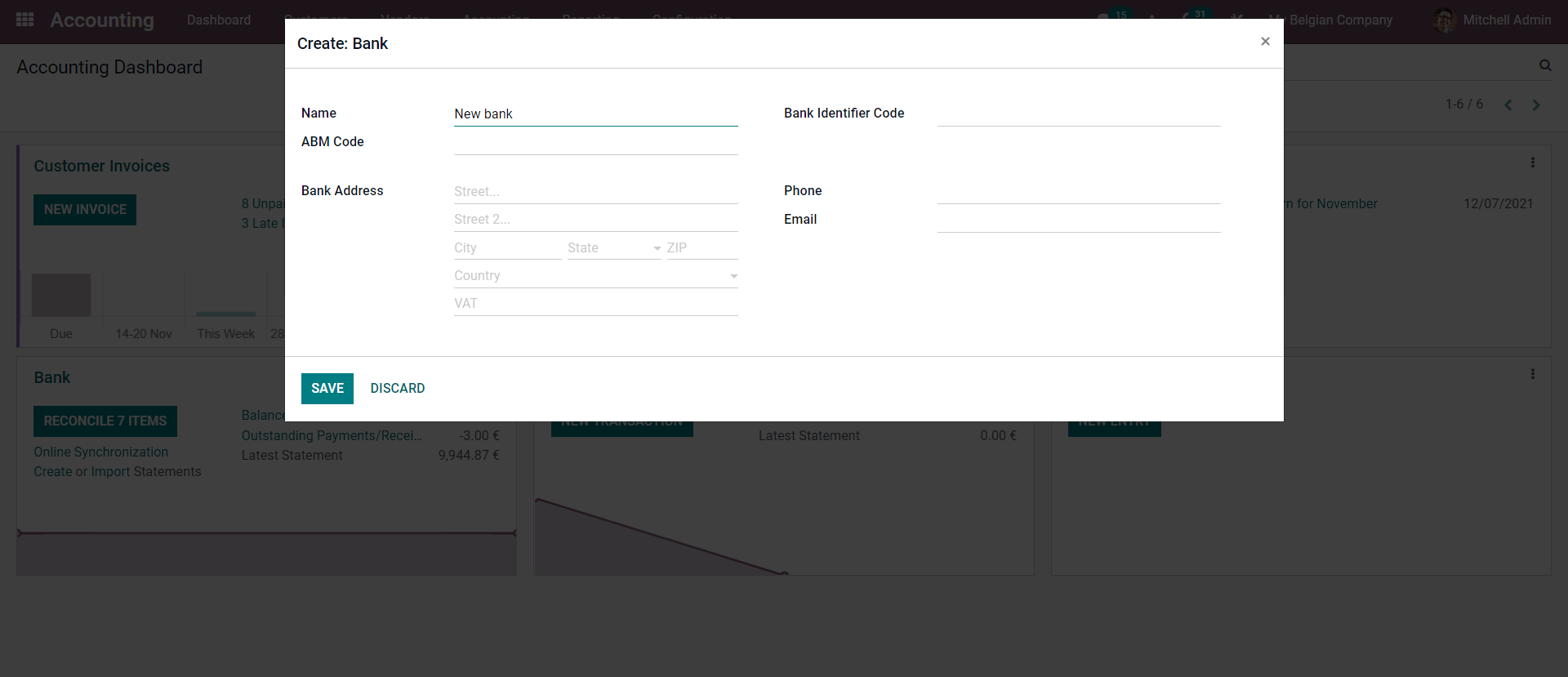

Odoo makes it simple to synchronize your bank account. Go to the Accounting module and select Add a bank account from the configuration section. This will open a configuration tab with a list of banks to which you may add your account, as shown below.

Conclusion: Odoo Bank Statement Management Benefits

To sum it up, The Accounting module's real-time data collection and management will allow you to quickly review current information with minimal clutter. Because Odoo is available because of its cloud-based infrastructure, you can simply manage your accounting procedures from anywhere, no matter how complex they are.

With Odoo, you can quickly manage and have a complete overview of your bank feed, as well as complete control over your data. With Odoo, you can simply manage even the most complex bank statements, and you can ensure that your business's cash flow is proper and not manipulated in any way thanks to real-time data updates from the Accounting module.

Odoo Bank Statement Management Benefits