Odoo Invoicing Module for Saudi Arabia (eInvoicing)

The way people used to do business has changed as a result of technological advancements. This is especially true for companies that serve worldwide markets and have a big customer base. Business transformation with the technology used to be solely about adopting automation, and people didn't look at it from an efficiency standpoint. However, the situation has changed dramatically. Automating any business activity is now a must, since failing to do so may unwittingly drag your company back into such fierce competition. When it comes to corporate automation, technological advancements have aided organizations in their search for numerous choices. To put it another way, technology adoption isn't just for automation; it also helps organizations obtain a competitive advantage through increased efficiency.

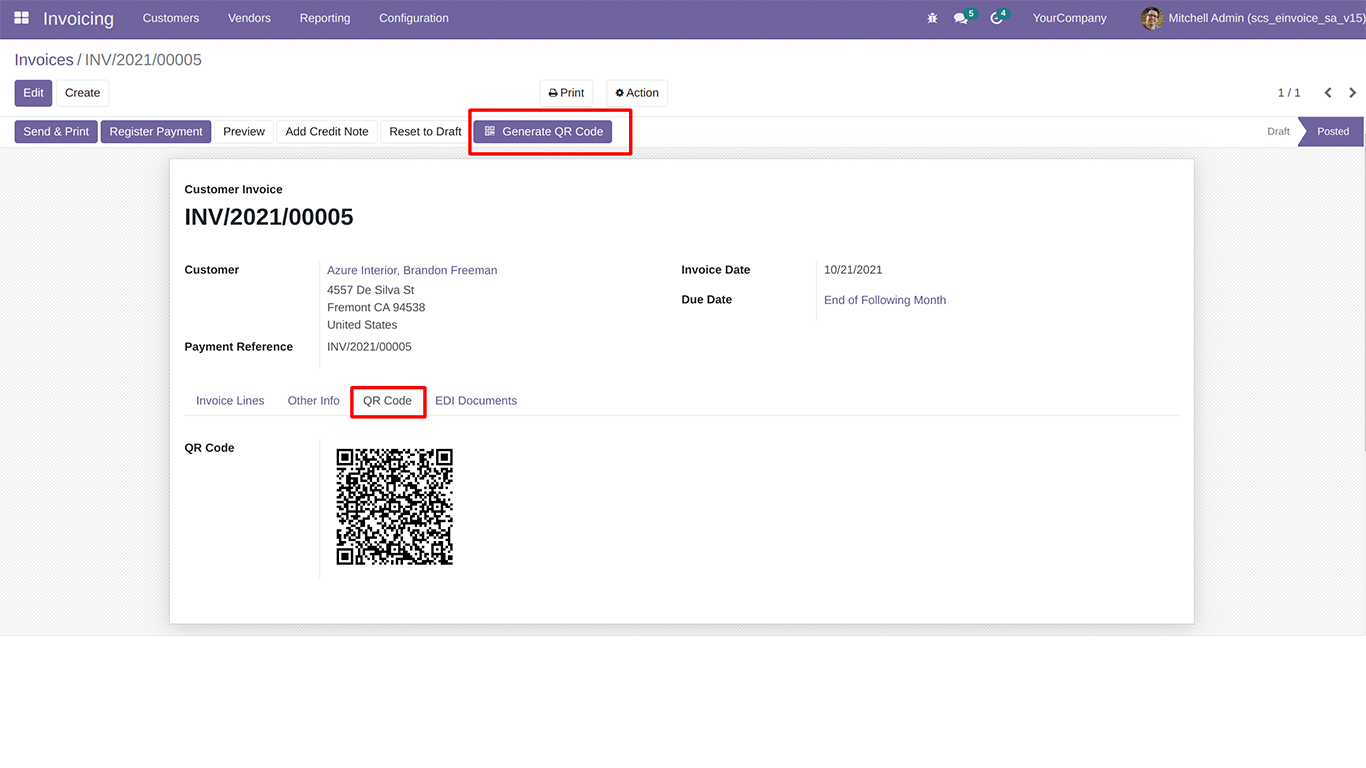

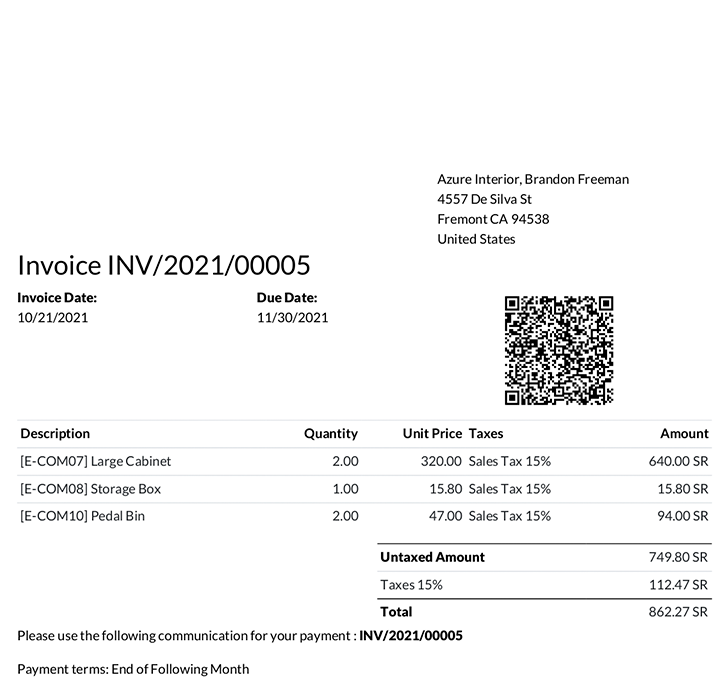

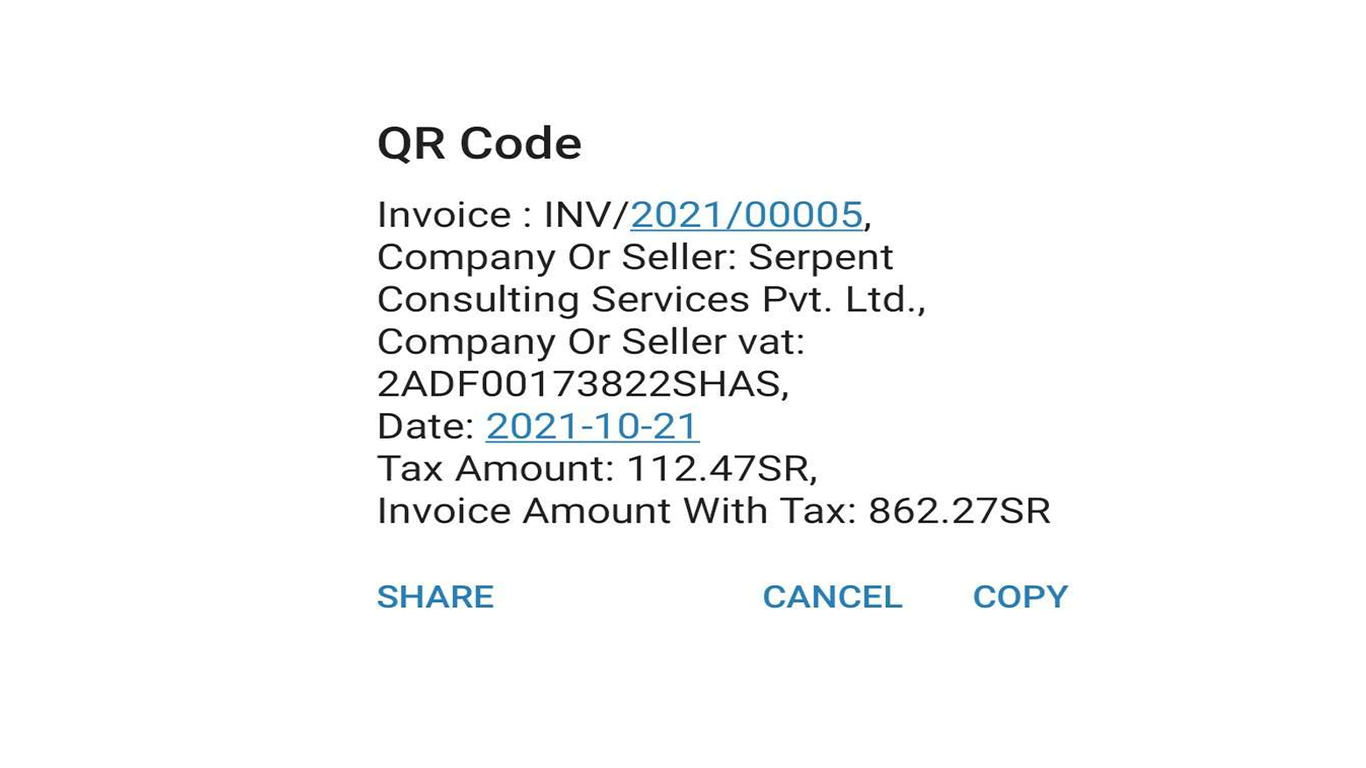

This article goes on to discuss one of the Odoo framework-based solutions, in which a customer can either pay from a link or learn about the invoiced amount by scanning the QR code issued by the system. E-invoicing is a market-leading initiative, and technology product firms have advanced it by providing the methods by which we now invoice our clients electronically.

Saudi Arabia's Odoo E-Invoicing

What is the benefit of e-invoicing?

The goal is to entirely eliminate the process that can lower the risk of fraud within any firm. Also, a scanned or photocopy of the invoice will not be regarded as an E-Invoice, and credit/debit notes should be included in the same document that is an eInvoice. The ZATCA regulations are met by our Odoo eInvoicing module.

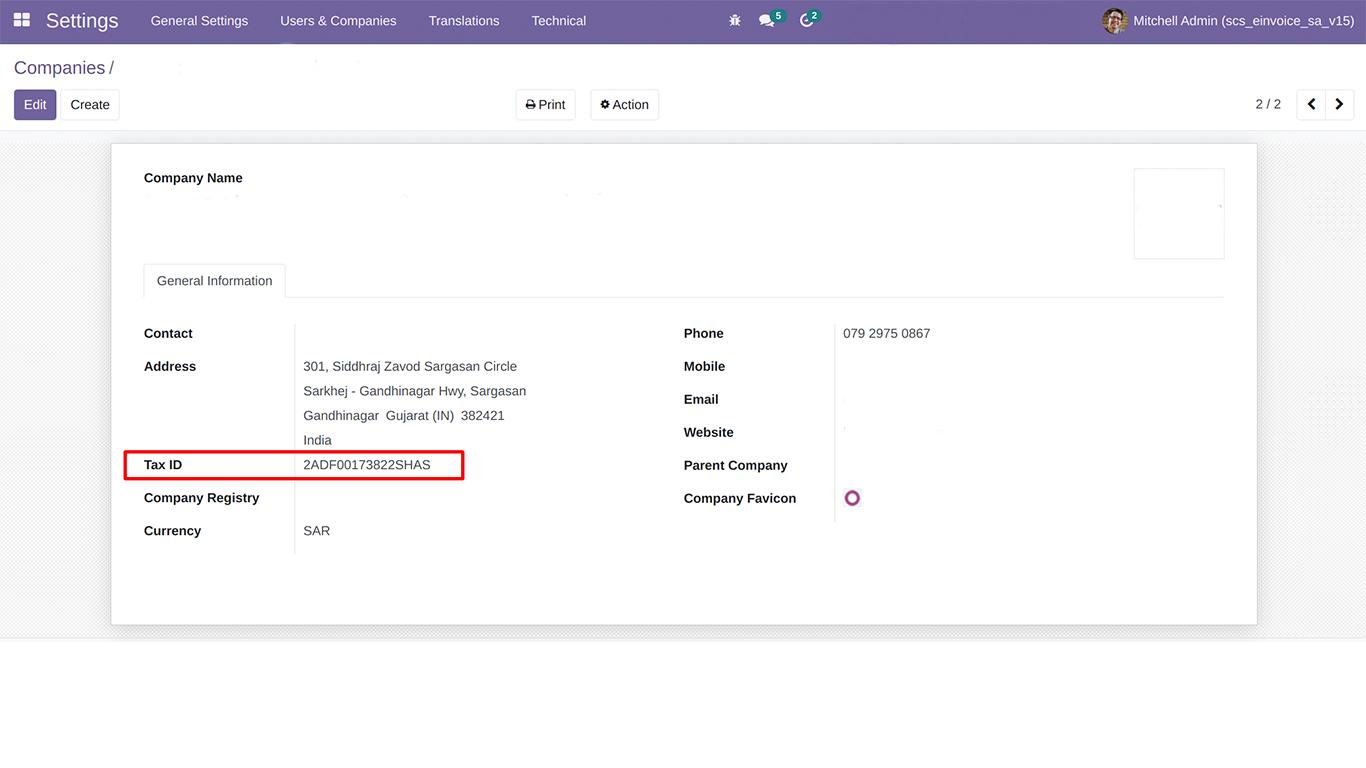

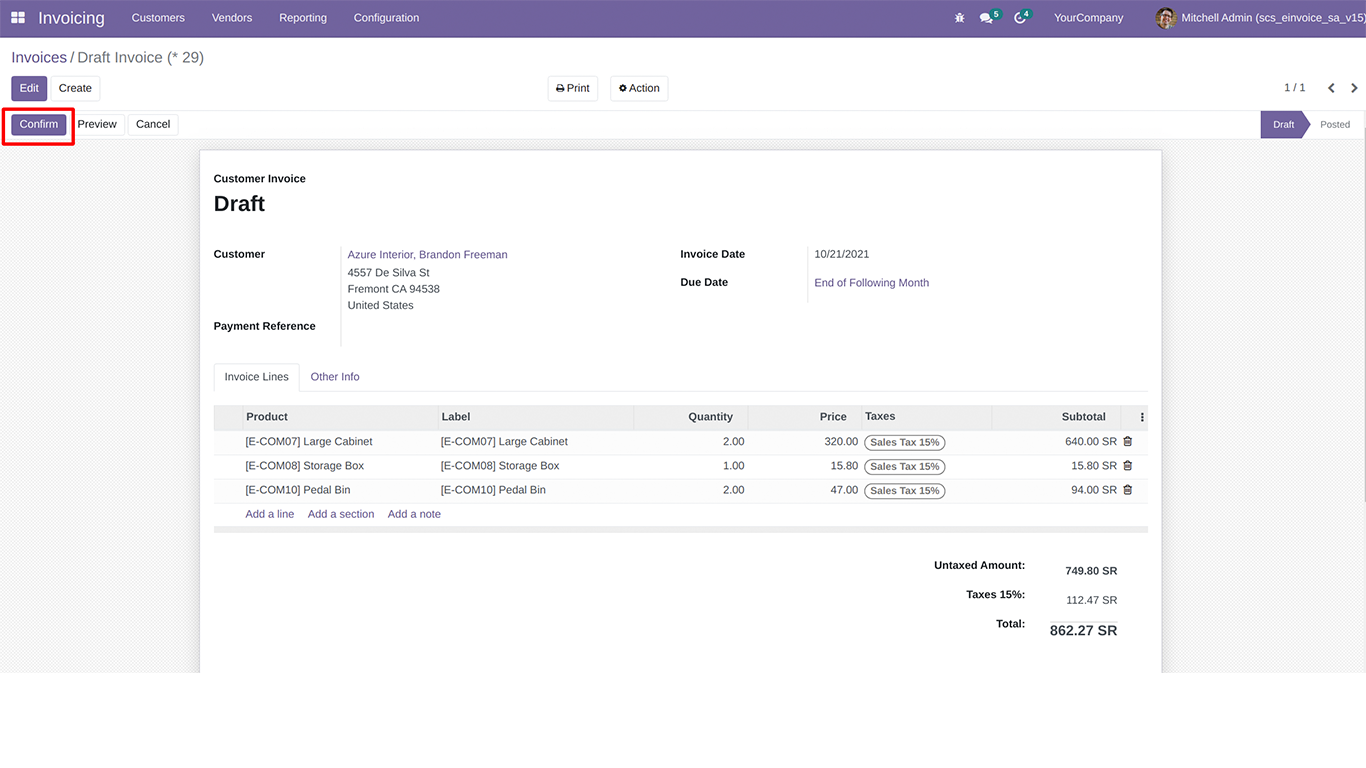

Let's take a visual tour of the process and see how the system works. We'll show you a series of screenshots from the Odoo E-Invoicing system in action for the Saudi market.

Odoo Invoicing Module (eInvoice)

Results of QR Scanning

Results of QR ScanningSaudi Arabia SCS eInvoicing

Looking for more add-ons and tools to help you run your business more efficiently?

Are you looking for software to help you run your business more efficiently?

We have a lot of ready-to-use software on hand.

Odoo Invoicing Module for Saudi Arabia (eInvoicing)