Simple Accounting Configuration With Odoo 14

Simple Accounting Configuration With Odoo 14

The adoption of an ERP system is a vital step. We must configure our functions and features whenever we adopt an ERP. Configuration in this context refers to enabling the functions of the ERP in such a way that they aid your business's operations. It is not feasible to begin operations just by adopting ERP or installing the module.

Instead, we will need to enter your company's data, fields, documents, and processes into the developed ERP program to make it a functional application. An ERP program may be designed to meet the needs of different business groups in different regions. You will need to customize some of the features to make them suited for your business.

There is a separate Configuration Menu for Odoo modules. This menu facilitates the completion of all configuration-related activities.

The Odoo 14 accounting module must be properly configured to ensure that your financial reports are created with the highest accuracy. To make Odoo 14 accounting your preferred tool, we must adjust several features.

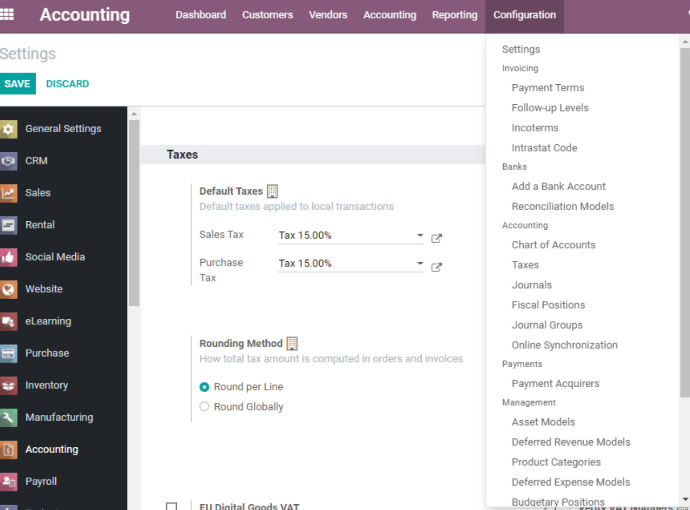

The Configuration menu may be found here.

We may locate settings and many more sections in this section. A plethora of features may be found underneath each part. Each of these aspects may be customized.

Invoicing, Banks, Accounting, Payments, Management, Analytic Accounting, and so on are some of the key segments.

Let's take a look at each of these.

Expenses

Payment terms, follow-up levels, incoterms, and intrastate code can be found below invoices.

Payment Conditions

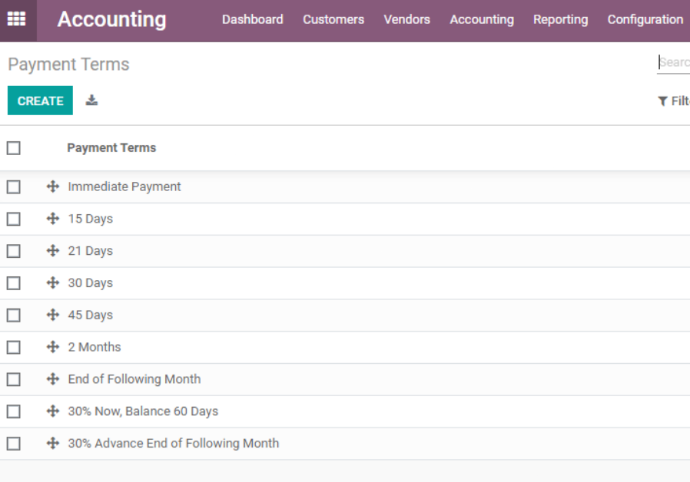

When we click on payment terms, we are sent to a screen where we may add additional payment terms.

All of the previously set payment conditions, such as immediate payment, payment within 30 days, end of the next month, and so on, may be found here. We may now add new payment terms by clicking the Create button.

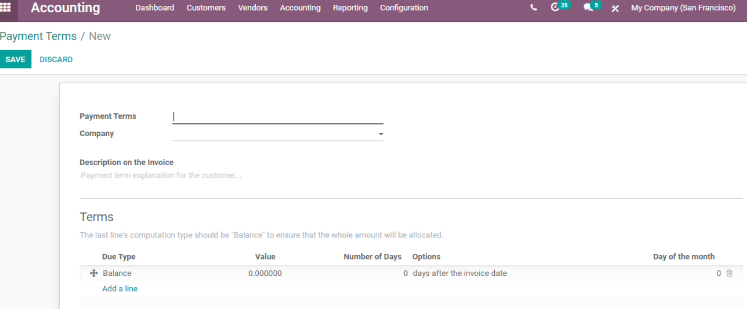

Payment terms, company name, invoice description, and terms may all be found here.

To establish new payment terms, fill in the data and then click Save.

Levels of follow-up

What are the different degrees of follow-up?

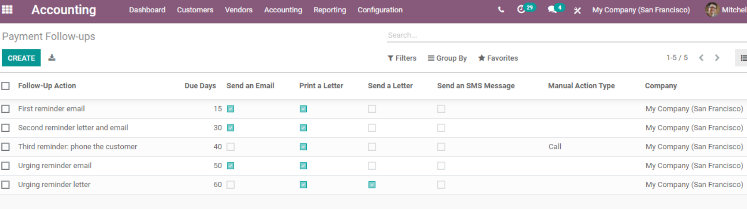

Payment follow-ups can aid you in the preparation of follow-up reports.

The payment follow-up levels that have been generated may be found here. These include the first reminder email, the second reminder letter and email, the third phone call to the consumer, the urge reminder email, and so on. We may specify due dates and record the status of reminders here.

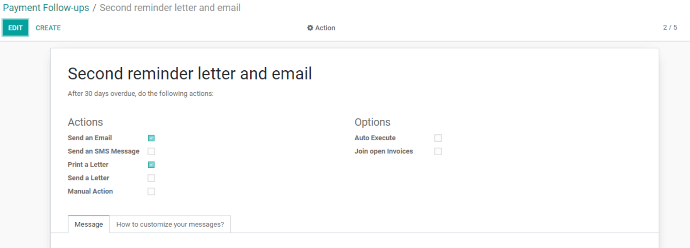

We may enable the actions and settings here. We may prepare the message and tweak it. We can set up both manual and automated follow-up reminders.

This is used to give consumers reminders about late payments or due dates.

Terms of reference

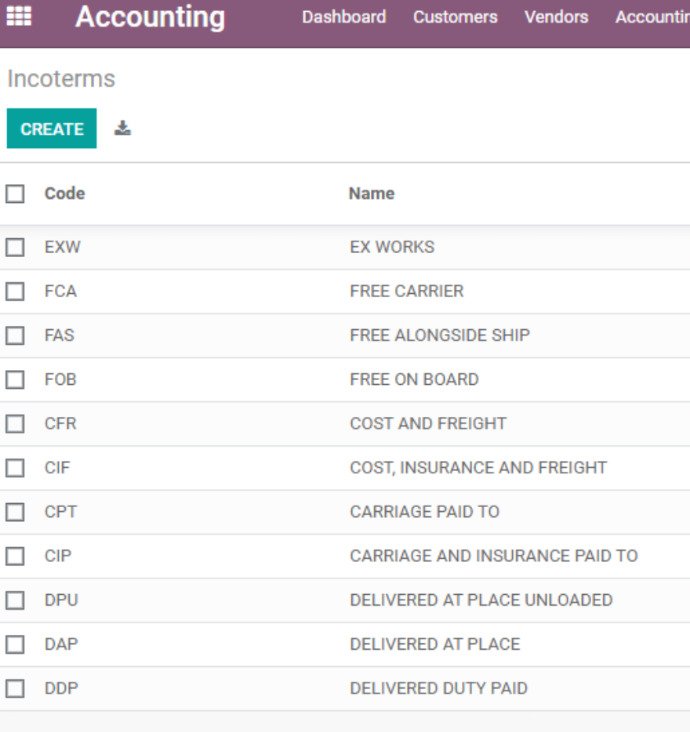

In Odoo 14 Accounting, International Commercial Terms are referred to as Incoterms.

These are the regulations that make buyers and sellers accountable for the transactions they engage in, particularly the delivery of products under a sales contract.

We can see the codes and names here. From here, we can also build new incoterms.

Banking Institutions

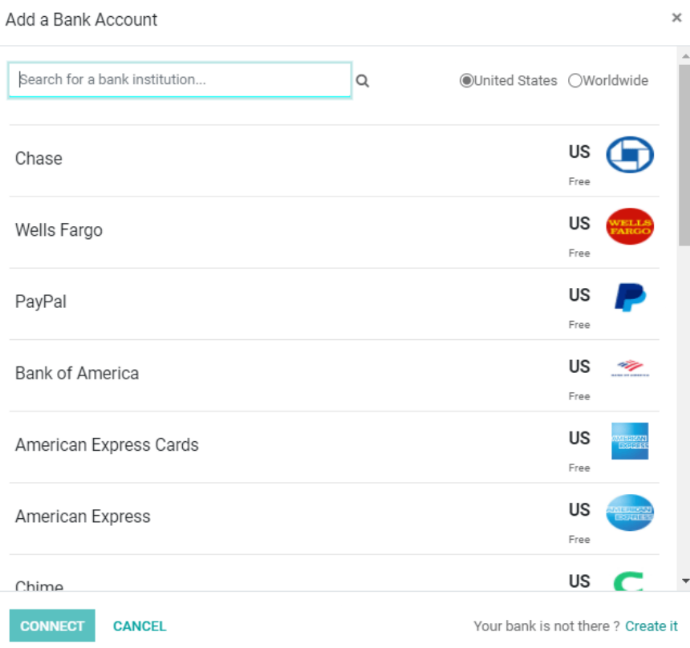

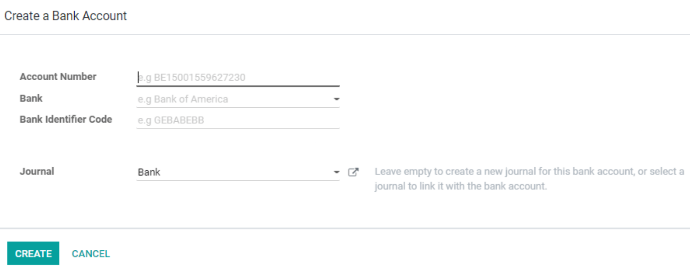

We can add a bank account and establish reconciliation models below banks. Include a financial institution.

When we click Add a Bank, we are sent to this page. Here, we may add additional banks and link them to our accounts. If your bank is not mentioned, we can create a new one.

When we open a new bank account, we must enter the account number, bank name, bank identifying code, and so on. We can also name the journal where you want the transaction data to be entered.

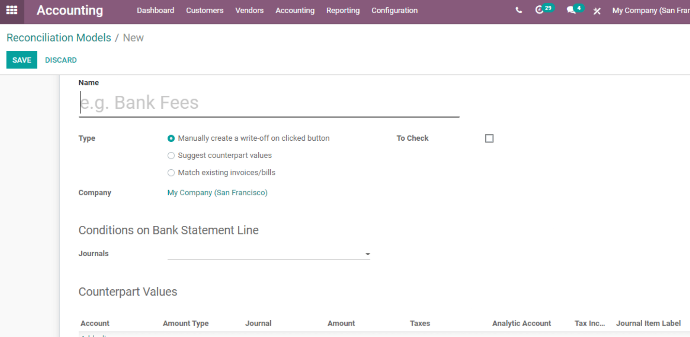

Models of Reconciliation

Reconciliation models assist us in reconciling bills and bank statements. We may develop reconciliation models by naming and categorizing them. Counterpart values and bank statement conditions can also be provided.

Accounting is the study of money

We may configure numerous elements below the accounting sector, such as Chart of Accounts, Taxes, Journals, Fiscal Positions, Journal Groups, and online synchronization.

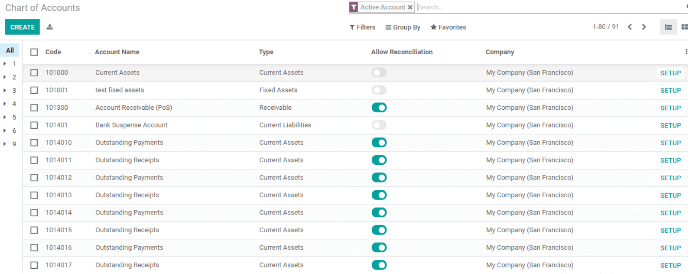

Accounts Chart

The Chart of Accounts allows us to establish codes, account names, account types, and so on. We can also accept or deny reconciliation in this case.

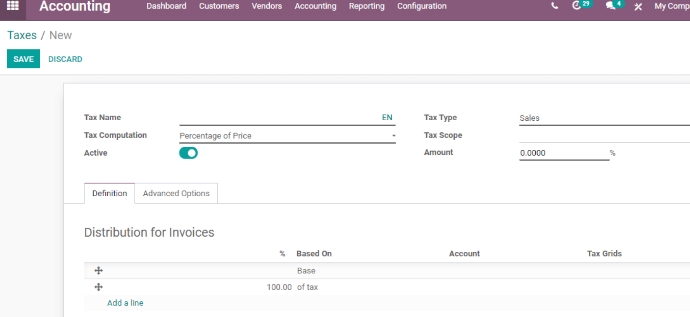

Taxation

Taxes can be established depending on tax type, tax scope, and other criteria. This is also where you may change the label on your invoices.

Taxation can be computed using a set of taxes, constant taxes, or a percentage of the price.

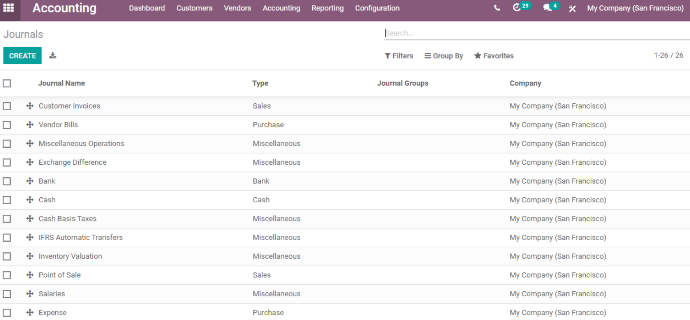

Odoo 14 Journals

We've already talked about the Accounting dashboard, where we spoke about how to configure multiple journals. We may also start new journals here.

Here we may change the name of the journal, the kind of journal, and so forth.

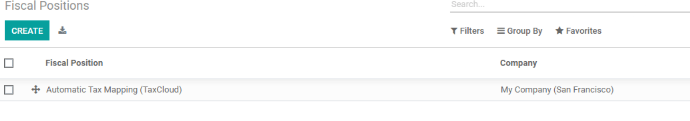

Financial Situation

Using Odoo 14 accounting, the fiscal situation can also be easily configured here. This is accomplished through the development of fiscal positions. We can impose taxes on products and set the amount of tax that will be levied. We can also turn on the option to automatically detect the fiscal status.

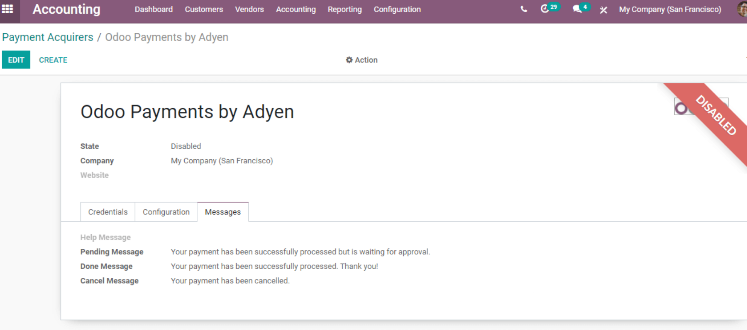

Receiver of Payment

Odoo 14 supports the use of many payment acquirers. We have the ability to develop and manage new payment acquirers. The payment acquirer form can specify the payment methods that are supported, the payment flow, and whether or not payment follow-up is enabled.

We may also set up a new account and specify notifications to be sent to the customer after the sum is paid.

Administration

Many functions can be adjusted beneath the Management segment. They do, Models of Assets:

- Models of Deferred Revenue

- Product Divisions

- Models of Deferred Expense

- Fiscal Positions

- Categories of Disallowed Expenses

- Analytical Products

We will cover the configuration of these in different posts because they all require extensive explanation.

Accounting Analytic

We must configure the Analytic Accounting category.

- Accounts Analytic

- Account Groups for Analytical Purposes

- Default Analytic Rules

We've already talked about Analytical Accounting in Odoo. For additional information, see What is Odoo 14 Analytic Account.

In future blogs, we'll go over more Odoo 14 Accounting settings and features. So remain tuned and keep up with our blogs. We want to offer our assistance in managing your Odoo Accounting module efficiently.

We provide assistance with Odoo deployment, modification, and training, among other things. For Odoo implementation and training support, please contact our experienced team. If you want to stay up to date, you can subscribe to our YouTube channel.

Simple Accounting Configuration With Odoo 14